02 Aug Online ITR filing charges across six tax filing websites compared for AY 2025-26

Additionally, there are several third-party websites available that can assist you in filling up the ITR form and its schedules. In the end, all submitted and verified ITR forms are processed through the e-filing ITR portal, but the methods used to fill up the form may vary.

The tax department’s portal allows you to file your income tax return (ITR) for free, but if you require help from a chartered accountant (CA) or specialised third-party websites, there will be a fee involved.

If you need more specialized help such as data extraction, tax planning, or other services, you will have to either hire a Chartered Accountant or use services from various websites like Clear, TaxBuddy, TaxManager, Tax2Win, etc., for which you may also have to pay a fee.

Now, let’s look at the different filing options and the costs associated with filing income tax returns on popular portals.

Also read: ITR filing 2025: Who can file ITR-2, who cannot file it for FY 2024-25 (AY 2025-26)?

What are the types of plans most ITR filing websites offer?

Broadly speaking, there can be three types of plans which most ITR filing websites offer:

- Self-filing: In this plan, you upload the documents and file the ITR yourself. You only get assistance with data handling and processing.

- Assisted filing: You upload the documents and then a computer algorithm designed with inputs from a Chartered Accountant will help you file the ITR.

- Consulting with a Chartered Accountant for ITR filing: Here, the website’s platform will set up a call or video call with their in-house CA/tax expert for a defined time, say 45 minutes. You can clear your doubts in this call and then file the ITR.

Source: Respective websites as of August 1, 2025

Also read: Error in ITR-2 online utility: CA highlights technical bug which may lead to taxpayers with capital gains income, carry forward loss getting scrutiny notices later

Note:

- Tax2Win has a plan starting from Rs 49 plus GST. In this plan you file the ITR yourself but use only the data extraction service of Tax2Win. You will not get the support of CA in this plan.

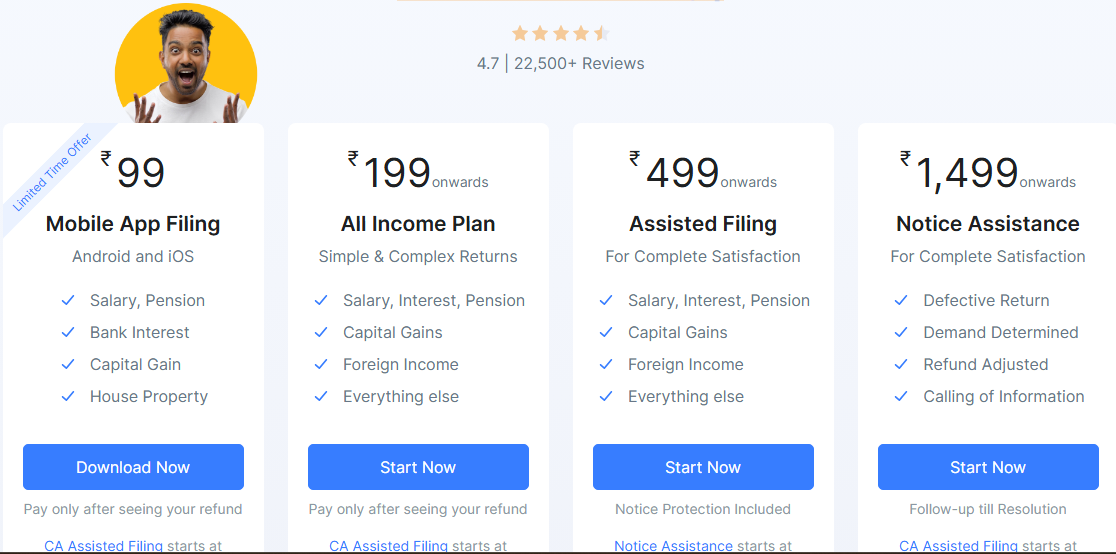

- Myitreturn has a plan starting from Rs 99 where you can file the ITR using their app, without any CA’s assistance.

Tax2Win