23 Aug The three big themes headlining the coming-of-age decade for Indian startups

The deepening of the startup ecosystem and the potential being unlocked by continued digital infrastructure investments – reveals a landscape primed for innovation and growth.

It’s been a whole year since India minted its last unicorn – its 108th. And given the frenetic pace with which unicorns were getting created for the couple of years before that – one cannot be blamed for buying into the doom-and-gloom picture being painted about the Indian startup ecosystem.

However, taking a step back and looking at the broader picture – across India’s robust fundamentals, the deepening of the startup ecosystem and the potential being unlocked by continued digital infrastructure investments – reveals a landscape primed for innovation and growth.

What’s Working In India’s Favour

Emerging from the pandemic, India’s economy has demonstrated remarkable resilience and will continue to be the fastest-growing major economy. We are today a $3.75-trillion economy – the world’s fifth largest – and expected to become the third largest by 2027.

Our economy is largely driven by domestic consumption, which makes us less vulnerable to global disruptions compared to other emerging markets. In addition, our external position has strengthened considerably over the past decade.

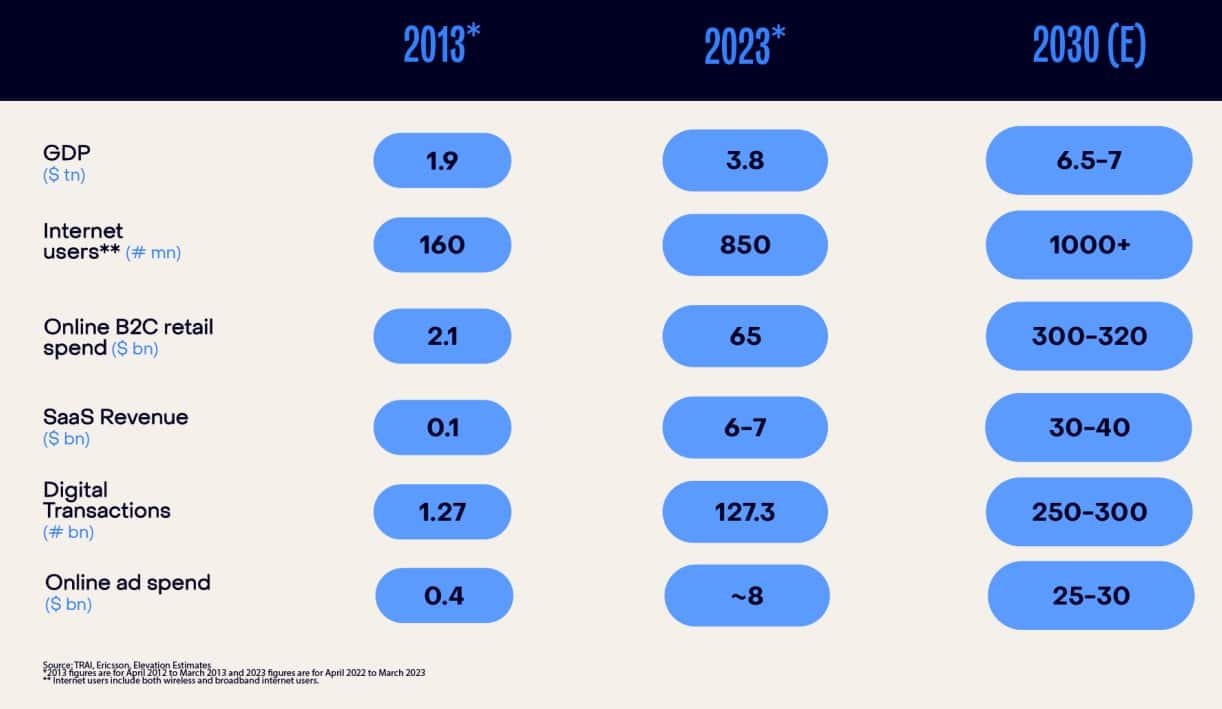

If we zoom in on the Indian tech ecosystem, we have come a long way in the last 10 years, with most indicators of digital penetration growing 10-30x. This growth will only accelerate in the next 10 years, making us a $1 trillion digital economy by 2030.

India’s demographics are incredibly promising for the country’s future. India has a young population, with 65 percent of people under the age of 35, who are digitally-savvy. As per capita income and discretionary spends grow over the next decade, more and more commerce and payments will shift online, and as a result tech-first businesses will capture a disproportionate share of value creation.

Adversity As Opportunity

Taking a closer look at the current investment environment, we are navigating a pronounced funding downturn. While this presents immediate challenges, we must recognise that such periods often serve as catalysts for improved efficiency and resilience, ultimately serving as a blessing in disguise.

Strong companies with solid execution are standing out in this environment, while those with poor governance or execution are being left behind. This will ensure that future capital and talent will be concentrated towards high-quality companies.

Startups across sectors are razor-focused on improving the health of their businesses and becoming profitable. Of the 100 odd unicorns in India, around 30 are already profitable, and we see at least another 15-20 having a clear line of sight to achieve break-even in the next one to two years.

Just in the last few months, four companies across very different sectors – Paytm, Freshworks, Meesho, and Zomato – turned profitable. As we come out of this funding winter, we will have 50+ large and profitable tech companies which will continue to invest back in the digital economy over the next decade, just as the FAANG have done in the US, or Alibaba and Tencent have done in China.

As we look at the next decade, we continue to be excited about three big themes:

1) Consumer

2) Fintech/financial services

3) SaaS (Software as a Service)

We believe that each of these will be multi $100 billion-plus opportunities.

Coming Consumption Boom

As India’s per capita income marches toward the $5,000 mark by the end of this decade, our retail market, which is currently $850 billion, is projected to grow to $1.6 trillion by then, of which, $300 billion will be online. As incomes go up, consumers tend to direct a greater portion of their spending toward organised channels and brands, which paves the way for flourishing consumer brands and platforms.

This transition will open new opportunities for brand creation, especially in discretionary categories like international travel, jewellery, beauty and personal care, luxury dining and cars. We expect the market capitalisation of all listed consumer companies in India to grow from $360 billion to $800 billion in 2030.

Of this incremental $440 billion in market value, $80-90 billion is expected to be generated by new companies that will be listed in the next seven years and will account for 10 percent of India’s overall market capitalisation. We expect around $30 billion of this will be contributed by new companies that are yet to be founded or are in their early stages.

The Fintech Revolution

The unabated growth in digital adoption combined with the government’s continued investments in building foundational elements of the tech ecosystem is catalysing a fintech revolution in India, opening up immense value creation avenues across payments, credit, insurance, and savings.

Fintechs are making meaningful inroads in the financial sector, commanding substantial shares in areas like digital payments (70 percent), retail lending (46 percent), and broking (49 percent). Their slice of the financial services revenue pie is set to grow from the current 5 percent to 20 percent by 2030. Consequently, out of the projected financial services revenue pool of $380-400 billion by the end of this decade, $75-80 billion will be addressable by fintechs.

With India’s young demographic, burgeoning middle class (projected to constitute 63 percent of the population by 2047), and globally-competent talent, we identify three key opportunity areas: Experience (small and medium business digitisation, seamless investing, niche segment targeting), Access (full-stack plays, vertical-specific solutions, embedded financial services), and Efficiency (CFO tools, fintech-financial institution collaborations, tech-led tools for identity, collections etc).

India’s SaaS Competencies

Indian SaaS startups have already made their mark on the global stage, and we believe that this trend will only accelerate from here. Annual revenues for the Indian SaaS industry are predicted to reach $30-40 billion by 2030. Remarkably, all of India’s ~25 SaaS unicorns so far were generated in the last five years alone.

Indian SaaS companies are highly capital efficient compared to their global counterparts and are able to build hybrid Indo-US sales, marketing and customer success teams, which help reduce CAC. Further, we have a new generation of product and GTM leaders who can understand customer pain points and build scalable products and GTM channels to serve global customers.

We foresee six major areas of value creation in India SaaS over the next decade – Dev tools, Vertical-specific SaaS, Manufacturing SaaS, Instrumentation layer for AI/LLM, GenAI-enabled application SaaS, and Cybersecurity.

India stands at the cusp of a transformative era, with all the conditions in place for an incredible decade of innovation and growth. As Indian investors who have been entrenched in the country’s technology landscape for more than two decades, we have never felt more excited about the Indian startup story than we do at this juncture. There is no better time than now to be All-In on India.

Mukul Arora is Co-Managing Partner, Elevation Capital. Views are personal, and do not represent the stand of this publication.