25 Mar Bulls back in action, but 22,000 crucial for Nifty direction in last week of March F&O expiry

Ashwin Ramani

March 26, 2024 / 01:59 AM IST

Nifty likely to move higher this week

The bulls are back in action and Nifty is likely to move higher in the current week starting from March 26.

Nifty started off previous week on a weak note, closing below its 50-day exponential moving average for the first time since November 13, 2023 on March 19, 2024. However, it recovered sharply in the last two trading days of the week to close 73 points higher at 22,097. Nifty bounced off from its crucial support of 21,850 level on the daily chart and reclaimed the important 22,000 mark.

Likely Equinox reversal on the cards in Nifty

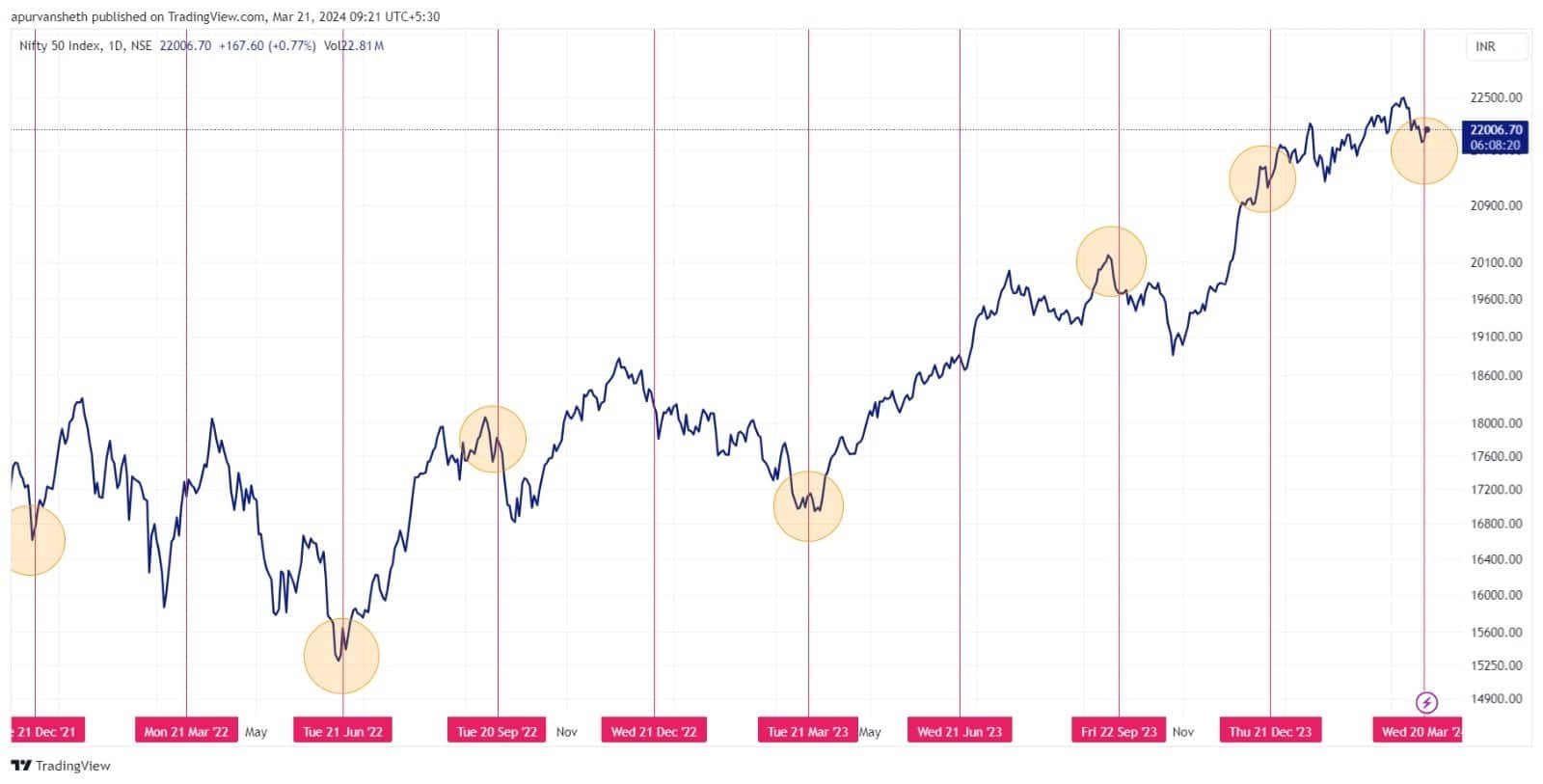

Historically, it is observed that on or during one of the two annual equinoxes or solstice, markets tend to change their trend. At the equinox, the length of the day equals to that of the night, twice a year around March 22 & September 22 in each year. The bull trends can change into bear trends and vice versa and many traders take advantage of this established fact.

The disclaimer is here that the trends do not always change at such times reversals, but one can always keep an eye for a likely trend reversal around these dates. In the image below, we can see how markets have changed trends around these dates. Nifty showed signs of reversal in the last two trading days and bounced from its critical support of 21,850.

Volatility cooling off giving comfort to the bulls

The India VIX, known as the fear indicator, made a high of 16.74 on February 28, 2024. Since then, the VIX fell nearly 27 percent to 12.20 on March 22, giving major comfort to the bulls. It has been seen that the volatility cooled off every time VIX came near 16.5 levels since the start of the year 2024.

Story continues below Advertisement

FPI Participation in Index Futures Likely to pick up Pace

The foreign portfolio investors (FPIs) have been liquidating their existing long positions and aggressively building short positions in Index futures. The Long-Short ratio fell from 37.55 percent on March 15 to 31.24 percent on March 20.

However, the last two trading sessions saw buying interest from the FPIs. The ratio improved from 31.24 percent on March 20 to 34.59 percent on March 22. The active participation from the FPIs in Index futures will drive further rally in the Index. FPIs increased exposure following US Federal Reserve’s dovish commentary in FOMC’s bi-monthly review meeting on Wednesday. As the road is clear for them now, going ahead till the next review, we may see considerable jump in FPIs’ activities across the equity market segments.

21,878 crucial support for Nifty

Nifty has formed a Hammer like pattern on the weekly chart after giving a lower close the previous week. Nifty has also managed to close above its 50-day exponential moving average of 21,878 after closing below it for two consecutive days in the current week. This level will act as an important support level for Nifty.

Maximum Put OI at 22,000 strike Ahead of March Expiry

The maximum Put open interest (OI) for Nifty is placed at 22,000 strike while the maximum Call open interest is placed at 23,000 strike. The option activity at the 22,000 strike will provide cues about Nifty’s future direction ahead of the last week of the March series Expiry.

The author is derivatives analyst at SAMCO Securities.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.