04 Jan IT, banking may drive markets in 2024 as stocks catch up with earnings potential: Quantum MF

Quantum MF believes that with India’s resilient economy and earnings growth the slightly expensive equity valuations will become reasonable.

Banks and information technology are the two frontline sectors that delivered relatively muted returns in 2023 even with a potential improvement seen in earnings trajectory. Coupled with the upside triggers, these two sectors could emerge as the major market drivers in 2024 as they catch up with the robust earnings expectation, said analysts at Quantum Mutual Fund.

For banks, a favourable credit cycle coupled with a revival in corporate credit offtake will drive earnings, said Quantum MF. On the other hand, a likely soft landing in the US can trigger a faster conversion of deal wins to lift earnings for the IT sector, the firm stated in a note. The report did not give any earnings or growth projections for both sectors and did not give a forecast of market gains and target levels.

Adding more to the plate are hopes of these two sectors turning out to be major beneficiaries of a return of FII flows, Quantum MF predicted.

Quantum MF bullish on Indian equities for 2024; here’s why

Aside from the specific sectors, Quantum MF also has a positive view on domestic equities over the near term. The optimism is driven by a favourable earnings cycle and policy stability which is likely to withstand the slightly expensive valuations of Indian equities. The one-year forward PE for Nifty and Sensex currently sits around 23. This is a bit expensive as compared to other emerging market peers but is significantly lower than the historical highs of around 29 seen during the pandemic period in 2020.

Moreover, the resilient domestic economy, reasonable earnings growth and expectations of stabilising the global economy as rate cuts commence could make valuations seem rational over time, Quantum MF stated.

Also, the clean sweep of the BJP in three major Hindi heartland states has somewhat eased concerns over a roadblock in policy continuity post the general elections of 2024. “Unlike prior election years, the base case of policy continuity could limit the volatility around the election period,” the firm highlighted.

Also Read | Tsunami of foreign flows, largest ever, likely in 2024: Marathon Trends’ Atul Suri

Story continues below Advertisement

The firm also listed three key triggers that could decide the market direction in 2024:

Demand pickup in mass segment

Demand in the mass market and rural segment has remained muted due to a sluggish recovery post the pandemic on account of inflationary pressures. In this regard, the mutual fund house expects that a moderation in inflation could support recovery in the mass market segment, further strengthening the ongoing economic upcycle.

Even though the earnings growth in recent quarters was driven by margin expansion, the firm believes that volume growth driven by broad-based demand could support earnings growth in 2024. What’s more encouraging is that volume recovery in rural-focused two-wheeler sales points towards green shoots in rural consumption.

Take the two-wheeler segment for example where volume growth was at 15 percent on year in December, catching up with the growth in passenger vehicles. For context, volume growth for passenger vehicles sustained through 2023 and rose another 6 percent in December.

Also Read | Market hits new milestones; ends 2023 with handsome gains

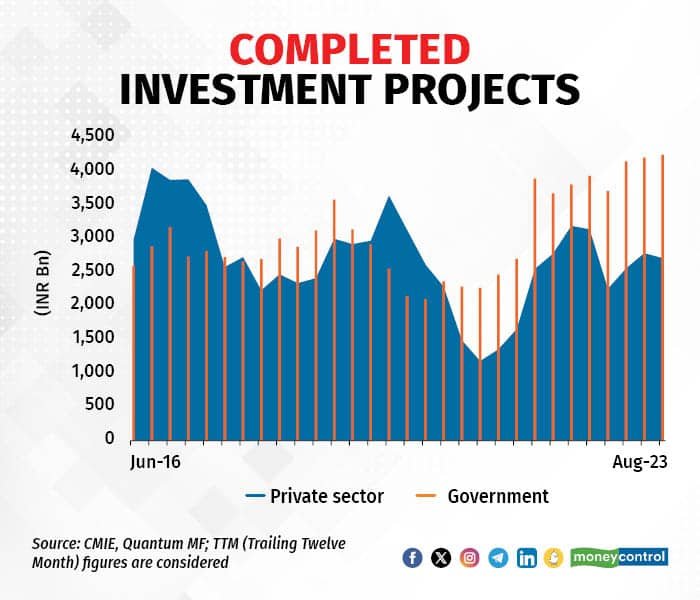

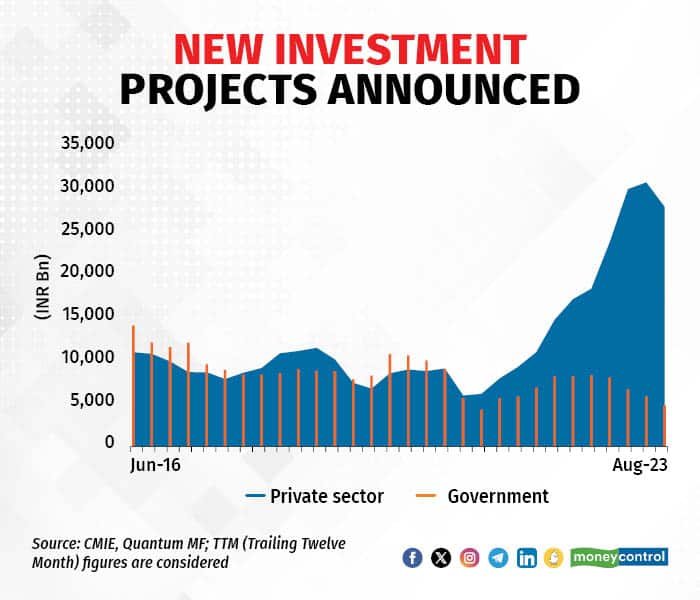

Private capex revival

A snag highlighted by most market participants in recent times is the reliance on government spending in boosting capital expenditure in recent quarters even as corporate spending is yet to catch up.

On that account, Quantum MF feels that a buoyant demand environment along with a pickup in utilisation could strengthen the private capex trajectory. Even though there are early signs of a revival, private capex still has a long way to go.

Foreign flows

Foreign flows

While DII flows have been robust for the past few years, rising global interest rates have kept FPI flows under check-in in 2023. To quantify that, DIIs have invested $20.2 billion in domestic equities in 2023 on top of their $35.8 billion investments in 2022.

On the other hand, FPIs have been rather cautious, with tepid flows at $12.8 billion in 2023, though still better than outflows of $16.5 billion in the year prior. All of this has resulted in FPI ownership in Indian equities hitting a decade’s low.

Nonetheless, Quantum MF remains optimistic about a return of FPIs to Indian equities after a tepid 2023 as global inflation and interest rates moderate. “Aided by a fall in inflation and rate cuts, India’s stable policy environment and resilient economy could attract meaningful foreign flows,” the firm believes.

Also Read | From return of FIIs to sustainable growth: 7 themes to ride on in 2024

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.