02 Jan Give momentum to your investments with the Max Life Midcap Momentum Index Fund

The recent surge in the Indian stock market has put a spotlight on the mid-cap and small-cap categories. This is clearly shown by data collated by Association of Mutual Funds in India (AMFI), that net inflows into midcap mutual funds have increased from around Rs. 83,000 crore in March 2018 to over Rs. 7 lakh crore in March 2023, indicating a CAGR increase of 54% over the previous 5-year period*. However, those planning to make investments into this category of schemes may be wondering how they can select midcap stocks that have the potential to grow their wealth in the future.

One way to do this can be by implementing a momentum strategy to midcap stocks to help pick stocks that have the greatest potential for further growth. This is why the Max Life Midcap Momentum Index Fund has been introduced.

This new Index Fund from Max Life Insurance will track the Nifty Midcap 150 Momentum 50 Index which has historically given CAGR returns of 26.8% (as of November 30, 2023) over the previous 10 years, as per data available on the National Stock Exchange (NSE) website. If you had invested Rs. 1 lakh in the Index in 2013, you would have received Rs. 10.74 lakh in 2023.

How Does the Momentum Investment Strategy work?

The momentum strategy focuses on selecting winning stocks i.e. stocks that have performed better than the broader market/stocks basket in the recent past and are expected to continue on this winning streak in the foreseeable future. So, a momentum investor typically identifies and invests in stocks that have witnessed some growth in the recent past but have the potential of growing even further in the future.

This is based on the rationale that stock prices have a tendency to persist i.e. stocks that have witnessed recent outperformance are likely to continue outperforming in the foreseeable future. So a momentum strategy involves investing in a stock once its price starts increasing i.e. when it starts gaining momentum. Conversely, the momentum investor will exit from a stock once it starts losing momentum.

A top-performing strategy index that selects midcap stocks by implementing a momentum strategy and has historically given 26.8% CAGR returns over a 10-year period is the Nifty Midcap 150 Momentum 50 Index.

What is the Nifty Midcap 150 Momentum 50 Index?

Story continues below Advertisement

The Nifty Midcap 150 Momentum 50 Index is a strategy index that comprises top 50 stocks ranked on the basis of the individual normalised momentum score of the 150 stocks that make up the broader Nifty Midcap 150 Index.

In order to arrive at the normalised momentum score, first the 12 months and 6 months’ momentum score of an individual midcap stock from the Nifty Midcap 150 index is calculated by using the below formula:

12 months Momentum Score = (12 months’ price return) / (Annualised standard deviation)

and

6 months Momentum Score = (6 months’ price return) / (Annualised standard deviation)

Next, the normalised momentum score of each individual midcap stock is calculated by giving equal weight to the 6 months and 12 months’ momentum scores. The 50 stocks that have the highest normalized momentum score among the Nifty Midcap 150 stocks are included into the Nifty Midcap 150 Momentum 50 Index. This is the index that will be replicated and tracked by the Max Life Midcap Momentum Index Fund.

The Nifty Midcap 150 Momentum 50 Index undergoes semi-annual rebalancing and reconstitution in June and December based on the individual stock data obtained on the last trading day of May and November. The weight of individual stock on the index is based on a combination of the normalised momentum score and free-float market capitalisation of each stock.

What Will the Max Life Midcap Momentum Index Fund Invest in?

As mentioned earlier, the Max Life Midcap Momentum Index Fund will replicate the Nifty Midcap 150 Momentum 50 Index. So, this index fund will invest in the same 50 stocks as the index in exactly the same proportion. Below is a snapshot of the top 5 stocks featured on the index based on their individual weight as of November 30, 2023:

| Stock Name | Individual Weight |

| Power Finance Corporation Ltd. | 6.68% |

| REC Ltd. | 5.72% |

| TVS Motor Company Ltd. | 5.62% |

| CG Power and Industrial Solutions Ltd | 4.67% |

| Trent Ltd. | 4.57% |

The above 5 and 45 additional stocks that are part of the momentum index are selected on the basis of their normalized momentum score and free-float market cap as per calculations made by the NSE. What’s more the individual stocks and their weight are liable to change on a semi-annual basis in June and December when the Nifty Midcap 150 Momentum 50 Index is rebalanced.

Additionally, the portfolio of the Max Life Midcap Momentum Fund will give investors exposure to variety of sectors ranging from Financial Services and Capital Goods to Healthcare and Consumer services. Below is snapshot of the weight of the top 5 sectors featured on the Nifty Midcap Momentum Index as of 30 November, 2023:

| Sector | Weight |

| Financial Services | 29.55% |

| Capital Goods | 22.31% |

| Automobile and Auto Components | 15.53% |

| Healthcare | 10.30% |

| Consumer Services | 8.85% |

How Has the Index Performed Historically?

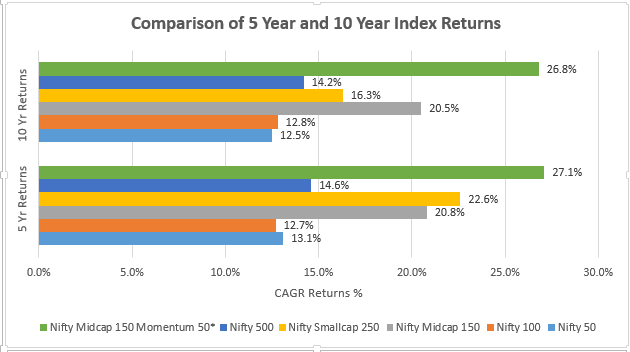

As compared to many other broad-based indices including the Nifty 50, Nifty Midcap 150 and Nifty Small cap 250, the 5 year and 10 year CAGR returns are significantly higher as shown below:

Note: Returns as of 30 November, 2023. The 5- & 10-year returns are CAGR returns.*Nifty Midcap 150 Momentum 50 Index was launched in Aug’22. The past returns are extrapolation of index fund returns up to past 20 years using same formula (provided by NSE).

Note: Returns as of 30 November, 2023. The 5- & 10-year returns are CAGR returns.*Nifty Midcap 150 Momentum 50 Index was launched in Aug’22. The past returns are extrapolation of index fund returns up to past 20 years using same formula (provided by NSE).

In case you are wondering what 10 year CAGR returns of 26.8% looks like, here’s an example. Suppose you had invested Rs. 1 lakh in this index in 2013, the value of your investment in November 2023 would be Rs. 10.74 lakhs. In other words, this is capital appreciation of over 10x in 10 years. While past returns by no means guarantee future performance, the Max Life Midcap Momentum Fund will try to replicate the future performance of this same index.

To get a clearer view of how the Nifty Midcap 150 Momentum 50 Index has performed in comparison to broader Nifty Midcap 150 Index, here’s a closer look at the instances of underperformance and outperformance based on daily rolling returns data over different time periods as of December 30, 2022:

| % of Total Instances of Outperformance & Underperformance of Nifty Midcap 150 Momentum 50 Index vs Nifty Midcap 150 Index | |||||

| Investment Period | Excess Returns Frequency (<0% CAGR) | Excess Returns Frequency (>=0% CAGR) | Excess Returns (0-2% CAGR) | Excess Returns (2-4% CAGR) | Excess Returns (>4% CAGR) |

| 10 years | 0% | 100% | 0% | 0% | 100% |

| 7 years | 0% | 100% | 0% | 0.7% | 99.3% |

| 5 years | 0% | 100% | 3.1% | 22.5% | 74.4% |

As you can see from the point to point rolling returns data in the above table, over long term investment periods of 5 years, 7 years and 10 years, the Nifty Midcap 150 Momentum 50 Index has outperformed the Nifty Midcap 150 Index in every case i.e. 100% of the time. This indicates that long-term investments made into the Nifty Midcap 150 Momentum 50 Index have historically yielded higher returns than the broader Nifty Midcap 150 index making the former a smart investment choice for long-term returns.

Why Should You Consider Investing in the Max Life Nifty Midcap Momentum Index Fund?

Some of the key reasons why you should consider investing in the Max Life Nifty Midcap Momentum Fund (apart from the high growth potential) include:

- Exposure to midcap space to diversify investment portfolio

- Benefit from the stock market momentum

- No Fund manager bias

- Life Cover

Quick Snapshot: Max Life Nifty Midcap Momentum Index Fund

Fund Objective: The objective of the fund is to invest in companies with similar weights as in the index and generate returns as closely as possible, subject to tracking error.

Investment Strategy: The fund will invest in a basket of stocks drawn from the constituents of NSE Midcap 150 Momentum 50 index.

Risk Profile: Very High

Benchmark: Nifty Midcap 150 Momentum 50 Index

Annual Fund Management Charge: 1.25% of AUM per annum

“This article is not written by MC Editorial”