06 Jul India’s macro management ‘stellar’ amid global turmoil, growth set to be durable: FinMin

The finance ministry has been bullish about the Indian economy, especially after the release of GDP data for January-March.

India’s macroeconomic management has been ‘stellar’ in the face of ongoing global challenges with economic growth being seen as more durable than before, the finance ministry’s economists said in the annual economic review report for 2022-23, released on July 6.

“Despite unprecedented global challenges in the last few years coming on top of balance sheet troubles in Indian banking and non-financial corporate sectors, macroeconomic management has been stellar,” the report mentioned.

“…India appears poised to sustain its growth in a more durable way than before,” it added.

The government has been bullish about India’s prospects, especially after the release of GDP data for January-March in late May, which showed growth surged to 6.1 percent in the last quarter of 2022-23 – far more than what any economist had expected. This led to the full-year growth estimate being bumped up to 7.2 percent from 7 percent.

Days after the release of the GDP data, Chief Economic Adviser V Anantha Nageswran said the Indian economy can now grow rapidly for an extended period of time without heating up and encountering problems like it has done in the past.

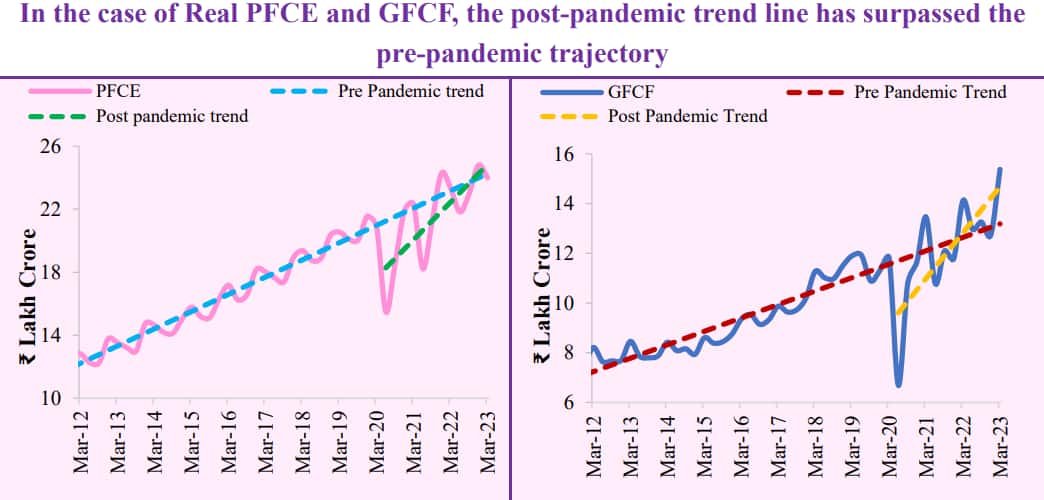

“The performance of GDP growth in Q4 of FY23 was broad-based and addressed all concerns about the recovery of consumption and investment demand to the pre-pandemic growth trajectory,” the ministry’s report noted, adding that real Private Final Consumption Expenditure and real Gross Fixed Capital Formation had surpassed the pre-pandemic trend trajectory.

Source: Ministry of Finance

Source: Ministry of Finance

However, negative net exports in real terms – which have jumped post-pandemic due to faster growth and high import prices – have prevented the post-pandemic real GDP trend line from crossing the pre-pandemic path.

“Given the decline in prices of India’s import basket and a sustained surge in service exports, the net exports gap is expected to become smaller sooner than earlier expected. This will enable real GDP to surpass its pre-pandemic trend trajectory in the near future,” the report said.

Both the government and the Reserve Bank of India (RBI) expect India’s GDP to grow by 6.5 percent in 2023-24.

On the price front, the finance ministry’s report expressed satisfaction, saying the impact of the RBI’s repo rate hikes, among other actions, on inflation has been satisfactory for India. The ministry pointed out that even though India’s interest rates did not rise by as much as some other countries in 2022-23, inflation remained close to the 2-6 percent tolerance band.

“This has much to do with calibrated fiscal stimulus provided by India during the pandemic as compared to major fiscal expansions undertaken by other countries,” it said.

Headline retail inflation averaged 6.7 percent in 2022-23, leading to the RBI’s failure in meeting its mandate and forcing it to write a report to the government in late 2022 explaining the same. However, a favourable base effect and declining global commodity prices have helped Consumer Price Index (CPI) inflation fall to a 25-month low 4.25 percent in May.

Overall, while the finance ministry appears confident, it called for some caution, saying it is “no time to rest on laurels nor risk diluting the painstakingly and consciously achieved economic stability”. It noted the risks facing India, namely escalation of geopolitical stress, increased global financial volatility, global stock price corrections, the El Nino, and “modest” trade activity and foreign direct investment inflows due to weak global demand.

“Should these developments deepen and dampen growth in the subsequent quarters, the external sector may challenge India’s growth outlook for FY24.”