29 Jun Want to build an emergency corpus? These debt funds come with a good track record

Low risk short term debt fund categories that can help your emergency corpus to grow and generate return over and above the banks’ savings and fixed deposits

June 29, 2023 / 01:35 PM IST

Building an emergency corpus is an essential part of financial planning. It comes in handy when you have sudden and unexpected expenses in life. Experts suggest to keep aside at least six months of your monthly income. Aside from savings accounts and bank fixed deposits, debt funds are also a good parking vehicle for an emergency corpus. There are low risk short term debt fund categories that can help your corpus to grow and generate return over and above the banks’ savings and fixed deposits. These include liquid funds, ultra short term funds, low duration funds, money market funds and short duration funds.

You can easily liquidate the units of debt mutual funds and get the money in your account in one-day. Interestingly, two debt funds categories (liquid and overnight funds) provide instant redemption facility wherein you get the money in your accounts in minutes. Typically, you can redeem up to Rs 50,000 or 90% of your portfolio in liquid funds per day. Only few MFs offer this facility, though, currently. Here we compiled top performing schemes from the short term debt funds include liquid funds, ultra short term funds, low duration funds, money market funds and short duration funds. Schemes were shortlisted based on the rolling returns and Sortino ratio. Keep in mind that these debt schemes do not guarantee returns. Though, they are the least volatile of all MF schemes. Source: ACEMF.

Nippon India Liquid Fund

Category: Liquid Fund

Corpus: Rs 24,687 crore

Fund managers: Anju Chhajer, Siddharth Deb and Kinjal Desai

DSP Liquidity Fund

Category: Liquid Fund

Corpus: Rs 12,654 crore

Fund managers: Kedar Karnik and Karan Mundra

Also read: Low-risk, high-return: 10 high-rated listed NCDs that give returns up to 10%

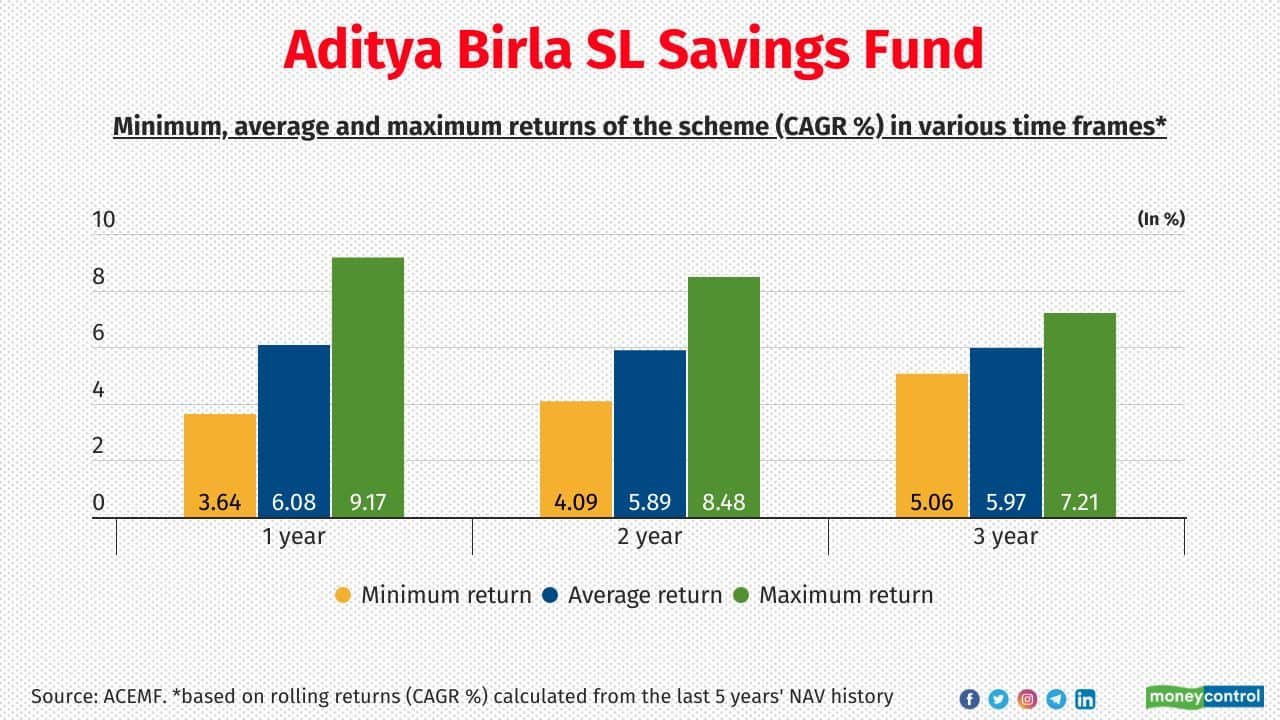

Aditya Birla SL Savings Fund

Category: Ultra Short Duration Fund

Corpus: Rs 15,041 crore

Fund managers: Kaustubh Gupta, Sunaina da Cunha and Monika Gandhi

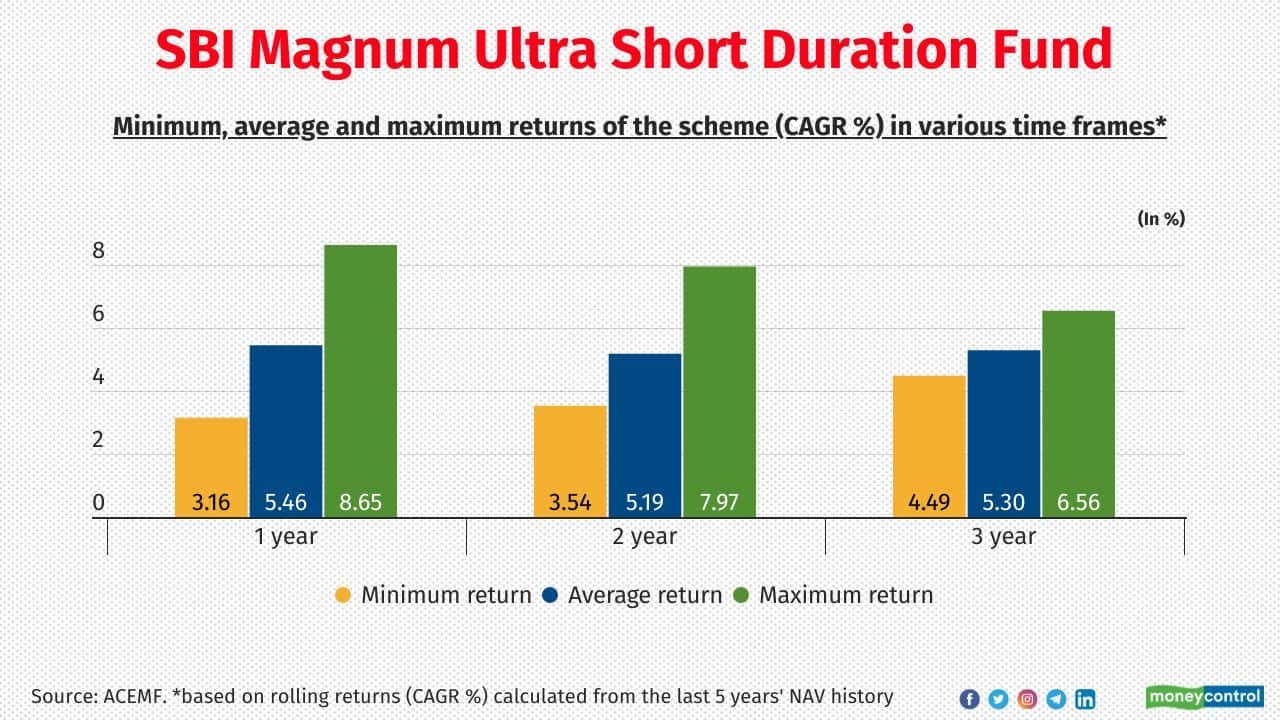

SBI Magnum Ultra Short Duration Fund

Category: Ultra Short Duration Fund

Corpus: Rs 13,324 crore

Fund managers: Ultra Short Duration and R. Arun

Also read: Six fixed income products for you in this high interest rate scenario

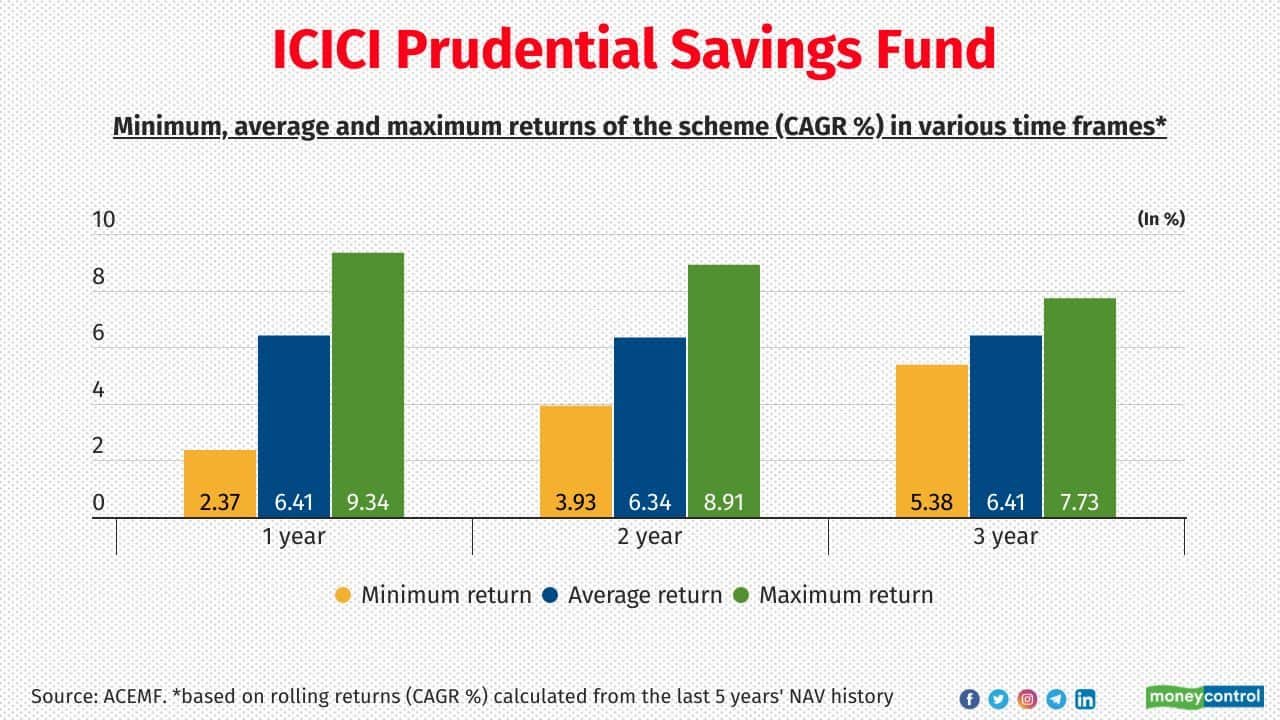

ICICI Pru Savings Fund

Category: Low Duration Fund

Corpus: Rs 17,851 crore

Fund managers: Manish Banthia, Rohan Maru and Darshil Dedhia

Kotak Low Duration Fund

Category: Low Duration Fund

Corpus: Rs 8,811 crore

Fund managers: Deepak Agrawal and Manu Sharma

Read here: SIPs work for debt funds, too. And, they beat bank FDs. Here’s the proof

Aditya Birla SL Money Manager Fund

Category: Money Market Fund

Corpus: Rs 14,496 crore

Fund managers: Anuj Jain, Kaustubh Gupta and Mohit Sharma

UTI Money Market Fund

Category: Money Market Fund

Corpus: Rs 9,117 crore

Fund managers: Amit Sharma and Anurag Mittal

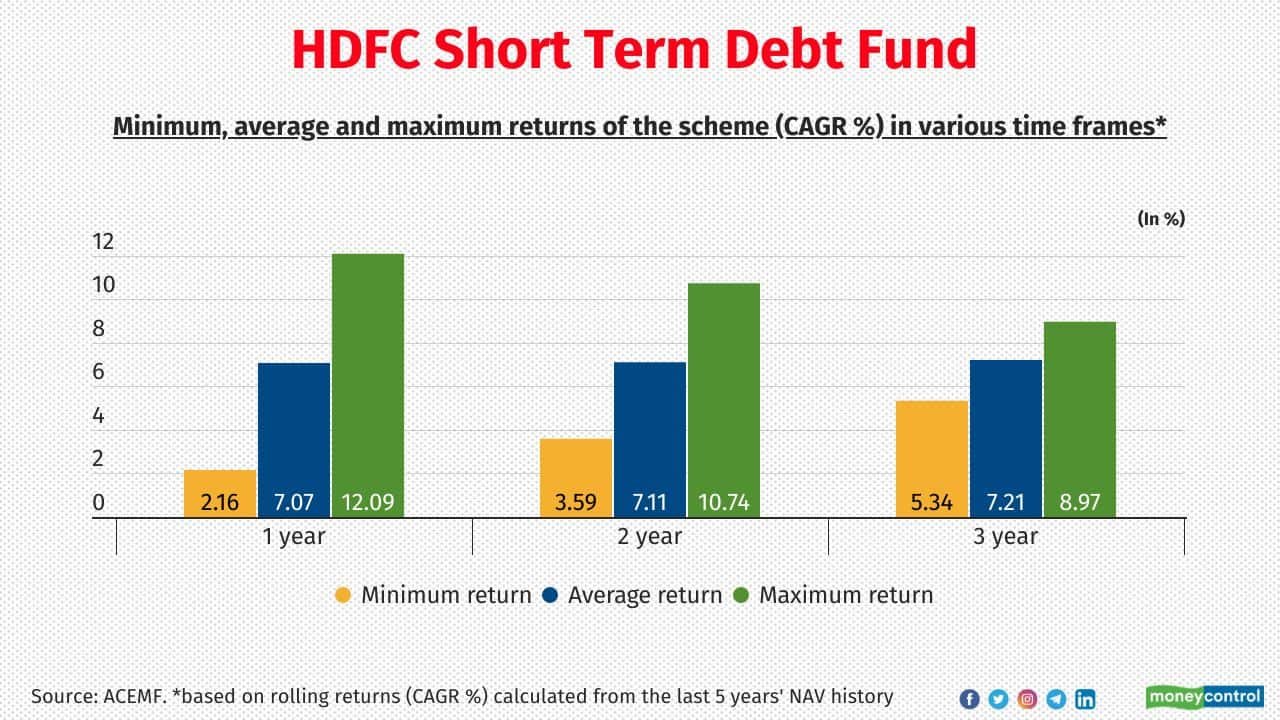

HDFC Short Term Debt Fund

Category: Money Market Fund

Corpus: Rs 12,320 crore

Fund manager: Anil Bamboli

Also read: HDFC Short Term Debt Fund: An all-weather debt fund has delivered across rate cycles

ICICI Pru Short Term Fund

Category: Short Duration Fund

Corpus: Rs 17,906 crore

Fund managers: Manish Banthia and Nikhil Kabra

Axis Short Term Fund

Category: Short Duration Fund

Corpus: Rs 7,415 crore

Fund manager: Devang Shah

Also read: 12 new midcap stocks that PMS fund managers picked lately. Do you own any?

Dhuraivel Gunasekaran