28 Jun With eye on food inflation, govt ready to keep check on prices of key items

Food inflation is seen as a key risk to headline retail inflation, which is seen rising in the coming months after falling to 4.25 percent in May.

The government is ready to take further steps to ease price pressures for key food items, with the option of reducing import duties on the table, government sources told Moneycontrol.

“There is a discussion going on in the ministries on what may be done to reduce the rising inflation in food prices. We may slash (wheat) import duties if our measures do not show results in the next few weeks,” an official from the commerce ministry said, requesting anonymity.

Currently, there is an import duty of 40 percent on wheat.

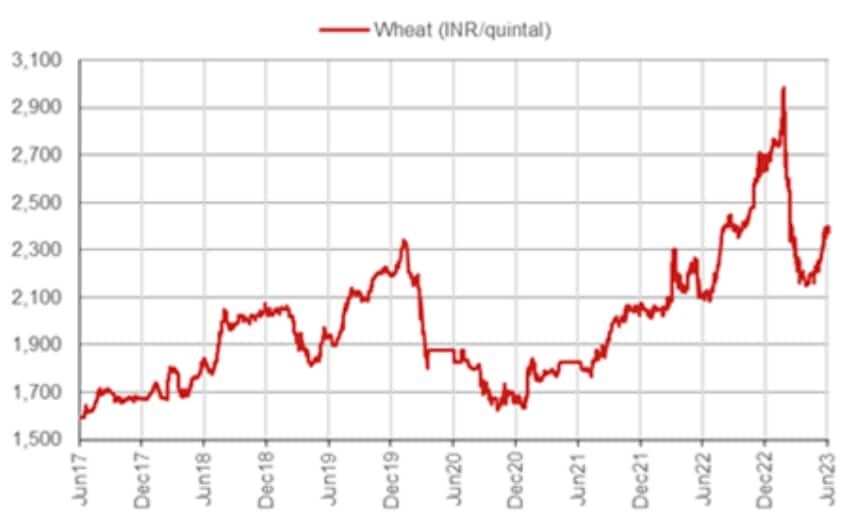

Although food inflation, as per the Consumer Price Index (CPI), fell to an 18-month low of 2.91 percent in May, certain key items continue to see elevated price pressures. Wheat inflation, for instance, has been in double-digit territory for the last one year, although it has come off its peak in recent months to stand at 12.61 percent in May.

Food inflation is seen as a key risk to headline retail inflation, which is seen rising in the coming months after falling to 4.25 percent in May.

The government has already taken several steps to bring down food prices. On June 12, the Centre imposed stock limits on wheat for the first time in 15 years. Further, the Food Corporation of India (FCI) was instructed on June 23 to conduct open market sales of wheat and rice.

In cases where stocks were higher than the prescribed limit, the holders were given 30 days—or until July 12—to lower their stock to within prescribed limits.

“Hoarding issues are still not over as we have given them a time of about a month to lose stocks. The changes in food prices should reflect in about two weeks. If the prices still do not reduce, we will consider reducing import duties on wheat,” an official from the food ministry said.

Source: Nomura

Source: Nomura

As per data from the Department of Consumer Affairs, retail prices of wheat were 1.3 percent higher on average in June compared to May. Nomura analysts, however, said in a note on June 27 that wheat prices are down 9 percent quarter-on-quarter from their recent highs “with the new harvest coming in”.

Production and procurement

A bone of contention is the government’s estimate of wheat output. As per its third advance estimate, wheat production in the country has been estimated at 112.74 million tonnes. This would be a new record and about 5 million tonnes higher than last year.

However, industry experts claim actual production may in fact be lower by 10 percent or so.

“Production has been down in the past two years due to climatic issues the country is facing,” Anand Chandra, executive director at Arya.ag, India’s largest grain commerce platform, told Moneycontrol on June 16.

“The prices have primarily gone up due to a reduction in supply and not because of hoarding. In fact, at this time last year, we held about 1 million tonnes of wheat, whereas it is 0.6 million tonnes this year,” Chandra added.

Arya.ag operates more than 3,000 wheat storage facilities across the country.

In terms of procurement, last year’s numbers have already been surpassed. As on June 21, wheat procurement during the ongoing rabi season was 26.2 million tonnes against last year’s total procurement of 18.8 million tonnes. However, comparisons to last year are misleading as the government’s procurement in 2022-23 was the lowest in almost 15 years.

The wheat procurement target for 2023-24 has been set at 34.15 million tonnes.

Other food problems

Cereals aren’t the only pricey issue for Indian households, with pulses too becoming dearer.

Data from the Department of Consumer Affairs shows prices are higher in June over May for four of the five pulses on which information is collated, with tur dal being the clear problem. While prices of urad, moong and gram dal were up 1.9 percent, 0.9 percent and 0.7 percent month-on-month, respectively, in June, tur dal prices were up a huge 6.2 percent.

Like wheat, the government has been taking measures to keep tur dal prices in check—from removal of procurement ceiling for tur, urad, and masur to imposing stock limits. Most recently, on June 27, the government said it would release tur dal from the national buffer “in a calibrated and targeted manner till imported stocks arrive in the Indian market”.

“Tur is the only issue among pulses,” another source said.

“One way to tackle the problem can be to tweak the agreements we have with Mozambique and other nations and increase tur imports,” the official added. India has five-year agreements with Mozambique, Malawi and Myanmar for the import of pulses.

Milk inflation has been another area of concern, with a variety of factors taking a toll on milk production and, therefore, prices. Retail milk inflation edged up to 8.9 percent in May, while wholesale milk inflation was at a six-month low of 6.8 percent last month.

“Milk inflation can be reduced by reducing the import duty on skimmed milk powder. But that can be difficult as cooperatives will have to put up with possible dumping by big dairy nations like New Zealand,” the same official added.

India currently has an import duty of 60 percent on skimmed milk powder.

Another official said the supply of milk should improve in coming months. “Monsoon months are supposed to be the flush season for milk production, as grass grows tall and cattle gets plenty of food and milk yield increases. This happens between July and September. We are expecting higher production here as well,” the official said.